Preface

The saga of Bank of Ceylon (BOC) began on 1st of August 1939 under Bank of Ceylon Ordinance No. 53 of 1938, the Governor of Ceylon, Sir Andrew Caldecott, declared open the maiden office of Sri Lanka’s first state-owned commercial bank in Fort, Colombo.

BOC is a licensed commercial bank established under the Banking Act No. 30 of 1988.The registered office is situated at No. 01, BOC Square, Bank of Ceylon Mawatha, Colombo 01, Sri Lanka.

Engaged In

Today having completed more than seven decades of glorious existence, the Bank is firmly entrenched as Sri Lanka’s premierfinancial services organization offering a broad range of services consists of commercial banking, trade finance, development financing, mortgage financing, lease financing, investment banking, corporate financing, dealing in Government securities, pawn brokering, credit card facilities, off-shore banking, foreign currency operations and other financial services. BOC holds the leadership position in its assets, deposits, and foreign currency remittances.

In Island Map and Beyond

As Bankers to the Nation, BOC reached out to all citizens of the country through its largest network over 600 branches connected online. BOC ATM network over 490 in numbers, serve the people 365 days 24 hours in all 25 districts of the country. The Bank has 13 Subsidiaries and 5 associate companies in its group structure.

BOC diversified its operations in the United kingdom by upgrading its first overseas branch, London branch to a fully fledged bank operating as a subsidiary of BOC named Bank of Ceylon UK Ltd. BOC operates in 02 overseas locations, namely, Maldives and Chennai. 2 ATMs are located in Maldives.

BOC represents the highest worldwide network with over 865 overseas correspondent banks and exchange companies. To serve the migrant communities of the country, we have expanded our services through our representatives at the exchange houses in Qatar, theUnited Arab Emirates, Kuwait, Bahrain, Oman, the Kingdom of Saudi Arabia, Israel, Jordan, Italy, South Korea, France and Japan.

Ratings and Listings

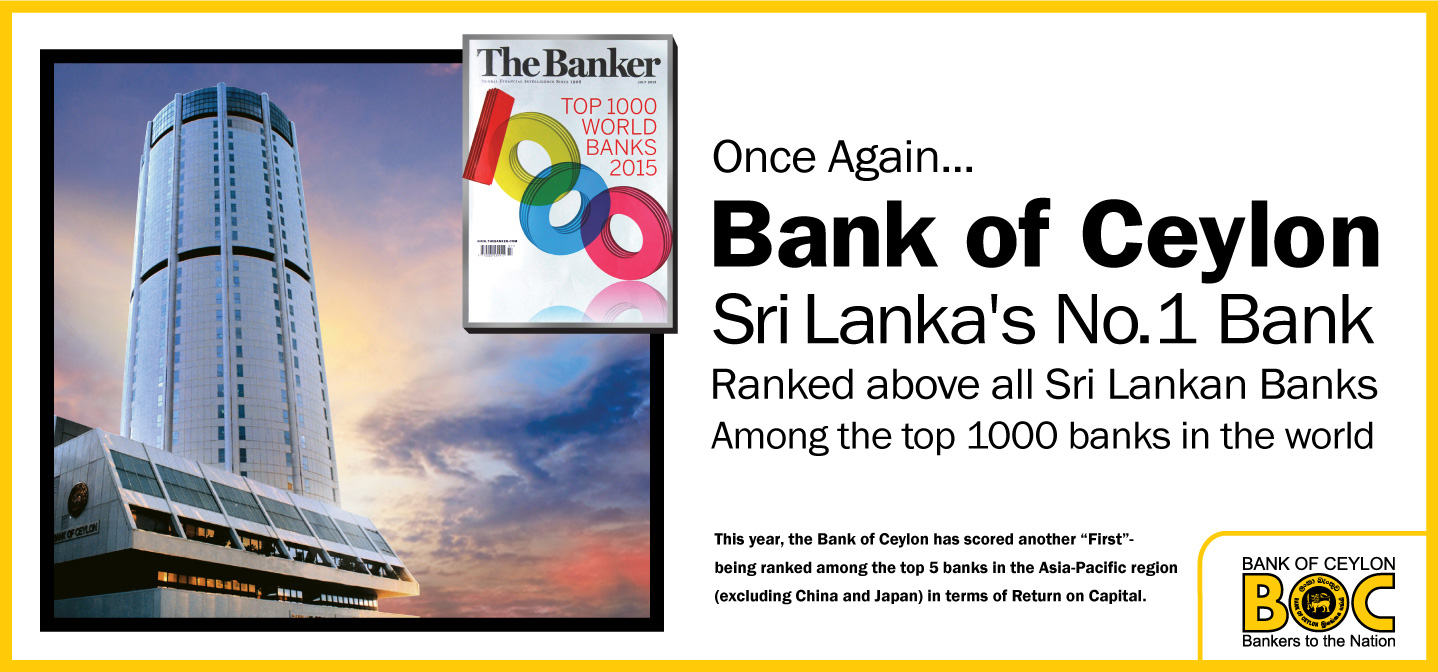

BOC became the No:1 brand in the country for the fifth consecutive year with a Brand value of Rs: 24.15 billion in the year 2013. M/s Fitch Ratings Lanka Ltd has upgraded BOC's outlook to positive from stable and simultaneously affirmed its National Long Term rating at AA(lka), reflecting Bank’s strong financial profile in terms of capital base, profitability and assets quality. The Debt securities ofBank of Ceylon were listed in the Main Board of Colombo Stock Exchange (CSE) from 19 December 2008 .

Governance

In attracting and maintaining public confidence in the institution especially because it is a Government-owned enterprise and the pivotal and dominant role of the Bank in the Sri Lankan economy carrying substantial influence and leadership over many matters of policy and practice, Bank of Ceylon pursues a strategy of being in line with best practices in respect of Corporate Governance. Bank complied with laws and regulations on Corporate Governance as the critical success factor of a sound control environment and improved operational efficiency and enhanced the brand image.

Community

As Sri Lanka’s foremost Commercial and Government Bank, BOC make significant contribution through sustainable financing, philanthropic and social investments whilst building a healthy business for the benefit of all our stakeholders.